Back

Pump and Dump Scheme

Slang

By HackQuest

Apr 2,20245 min readWelcome to the world of Web3, where cryptocurrencies, blockchain, and a unique culture converge. Entering the world of Web3 can be both thrilling and overwhelming, especially when faced with the seemingly cryptic language used by enthusiasts. Don't worry if you feel they sound like some secret codes, we are here to unravel their meaning in Web3 context. In this article, we are going to introduce [Pump & Dump].

What is the meaning of Pump & Dump?

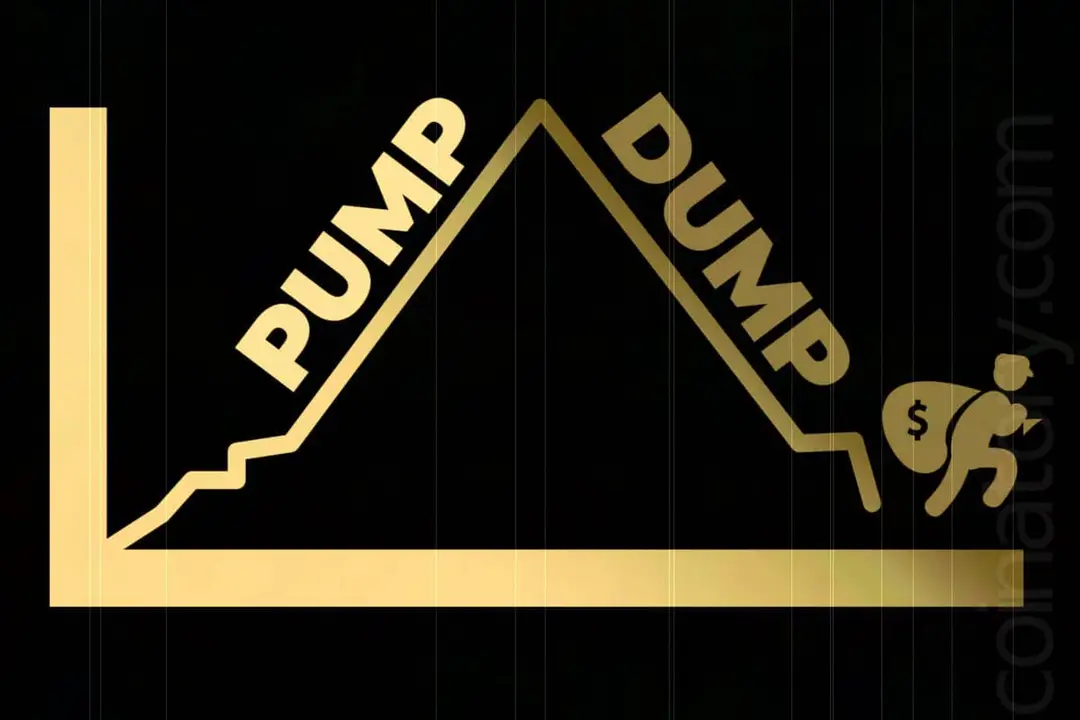

A pump-and-dump scheme is like a trick in the stock market or with cryptocurrencies. First, a group buys a lot of stock or digital coins. Then, they hype it up, often with exaggerated or false information, to make others excited about it. This "pump" drives up the price as more people buy in. Once the price is high, the group quickly sells ("dumps") all their shares at this high price. After they sell, the price usually crashes. This leaves many new investors with stocks or coins worth much less than what they paid, while the group that started the scheme makes a profit. This is illegal and very risky for regular investors.

Source: Westfair Business Journal

How to Avoid Pump & Dump?

Always do thorough research on any investment. Look into the company's financial health, business model, and market potential. Be wary of investing in stocks or assets that lack solid fundamentals.

🚀

Check out: What is the meaning of DYOR

Beware of Hype

Be cautious of stocks or assets receiving sudden, excessive promotion, especially through social media, unsolicited emails, or message boards. If it sounds too good to be true, it probably is.

Know the Risks

Certain cryptocurrencies are more susceptible to pump-and-dump schemes due to their low trading volumes and lesser regulatory oversight. Be particularly cautious in these markets.

Consult Professionals

If you're unsure, consider consulting with a financial advisor or investment professional who can provide guidance based on experience and expertise.

Stay Informed

Stay updated with legitimate news sources and market analysis. Sudden, unexplained surges in stock prices that aren’t backed by news or financial reports might be suspicious.

📢

Conclusion

In conclusion, pump-and-dump schemes represent a significant hazard in the financial world, particularly in less regulated markets like penny stocks and certain cryptocurrencies. These schemes involve artificially inflating the price of an asset through false or misleading information, only to sell off the asset at a high price, leaving unsuspecting investors with substantial losses. Awareness and education are key to avoiding such traps. Investors should always exercise due diligence, remain skeptical of unsolicited investment advice, and be cautious of investments with unusually high promotional activity. Remember, if an investment opportunity sounds too good to be true, it often is. By staying informed and vigilant, investors can better protect themselves against these fraudulent practices and make more secure investment decisions.

If you would like to learn more about such Web3 slang, let’s explore more in our HackQuest Web3 Glossary!