Back

Bullish

Slang

By HackQuest

Apr 2,20243 min readWelcome to the world of Web3, where cryptocurrencies, blockchain, and a unique culture converge. Entering the world of Web3 can be both thrilling and overwhelming, especially when faced with the seemingly cryptic language used by enthusiasts. Don't worry if you feel they sound like some secret codes, we are here to unravel their meaning. In this article, we are going to introduce [Bullish].

What is the meaning of Bullish?

"Bullish" is a term often used in the financial and investment contexts, referring to a positive outlook or confidence in the increase of a market, asset, or financial instrument. When investors are bullish, they believe that the prices will rise, leading them to buy or hold onto securities with the expectation of future gains. This term is derived from the way a bull attacks by thrusting its horns upward, symbolizing the upward movement of the market. The opposite is "bearish," which indicates a pessimistic outlook, expecting a decline in prices.

Crypto - Bullish 2024 signals

Regulatory Clarity: Positive regulatory developments in major markets could provide a more stable and trustworthy environment for crypto investments, leading to increased institutional and retail investment. The European Union approved its Markets in Crypto-Assets regulation, a world-first package of comprehensive laws for the crypto industry.

Technological Advancements: Breakthroughs in blockchain technology, such as scalability solutions, enhanced security, and energy efficiency, could attract more users and developers, boosting the utility and value of cryptocurrencies.

Institutional Adoption: If more large financial institutions start adopting or investing in cryptocurrencies, it could signal trust and stability in the market, attracting more investors. JPMorgan Chase, Morgan Stanley, and Goldman Sachs are among the firms with dedicated groups for cryptocurrency and its underlying blockchain technology. The JPM Coin digital currency is being used commercially to send payments around the world.

Mainstream Integration: Big companies like Amazon or Microsoft accepting Bitcoin or other cryptocurrencies as a payment method would be a huge step towards mainstream acceptance.

Global Economic Conditions: In times of economic uncertainty or inflation, cryptocurrencies may be viewed as a hedge, attracting more investors looking for alternative assets.

Innovation in DeFi and Web3: The emergence of successful and widely-used decentralized applications (dApps), especially in finance and Internet services, could drive demand for the cryptocurrencies powering these platforms.

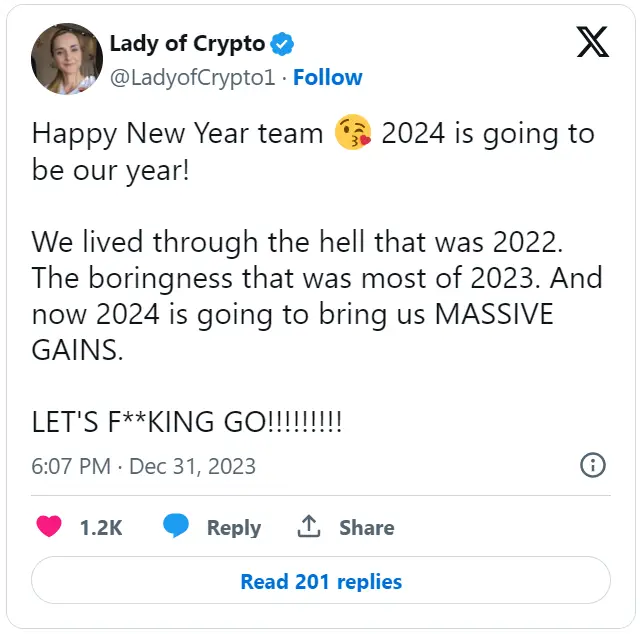

Positive Market Sentiment: A general trend of positive sentiment in media coverage and among investors could also contribute to a bullish outlook.

Success of Layer 2 Solutions: The widespread adoption and success of Layer 2 scaling solutions like the Lightning Network for Bitcoin or Optimism for Ethereum, which aims to increase transaction speed and reduce costs, could be a bullish sign.

Crypto ETFs and Investment Products: The launch and success of a Bitcoin ETF in the U.S., for example, would provide an easier and more regulated way for traditional investors to get exposure to cryptocurrencies.

Increased Public Awareness and Education: More universities offering courses on blockchain and cryptocurrencies, or mainstream media outlets providing regular, informed coverage of the crypto market, can lead to increased public understanding and interest.

If you would like to learn more about Web3 slangs, let’s explore more in our HackQuest Web3 Glossary!