Back

Moonshot Mafia #09 | Qiming Venture Partners: Innovation in Disruption

Fireside Chats

By Moonshot Commons

May 9,202318 min read

“Founded in 2006, Qiming Venture Partners is a leading China venture capital firm with offices in Shanghai, Beijing, Suzhou, Hong Kong, Seattle, Boston, and the San Francisco Bay Area.

Currently, Qiming Venture Partners manages eleven U.S. Dollar funds and seven RMB funds with $9.4 billion in capital raised. Since its establishment, it has invested in outstanding companies in the Technology and Consumer (T&C) and Healthcare industries at the early and growth stages.

Qiming Venture Partners is a top-tier VC firm with an outstanding reputation. It has been widely recognized by investors from around the world and has become an ideal VC firm for entrepreneurs. With its exceptional investment performances, Qiming has won multiple world-renowned venture capital awards.” (Visit Qiming Venture Partners for more information)

At Moonshot Commons’ Web3 Fireside Chat #9, we invited Yi Tang, Executive Director at Qiming Venture Partners, to talk about his investment philosophy, in-depth insights on the Web3 ecosystem, and his thoughts on fostering meaningful collaborations with entrepreneurs.

Yi Tang perceives the advent of the Web3 era as a reaction to a pervasive lack of trust in the existing system. This has sparked a creative and inherently disruptive force that has resulted in the creation of a new paradigm in digital technologies.

His fascination with the cryptocurrency industry began in 2016, during his studies at Columbia University. While exploring various early-stage startups in New York, he encountered ConsenSys, a pioneering company with just 50 employees at the time, situated in a Brooklyn factory adorned with graffiti on Bogart Street. Following a conversation with ConsenSys’ founder, Joe Lubin, Yi Tang was attracted by Joe’s vision and joined the company as a developer and quickly became the head of ConsenSys China. A few years later, Yi Tang observed a disconnection between the application layer and the underlying infrastructure, prompting him to make the transition from entrepreneur to investor.

Today as an Executive Director at Qiming Venture Partners, Yi Tang has become a supporter behind Web3 companies like InfStones and imToken. Yi Tang is always evaluating the vast potential of the Web3 ecosystem amid the ongoing chaos and volatility in the industry. He is firmly committed to promoting this new digital paradigm that can usher in a more secure, transparent, and decentralized future for humanity.

Key Takeaways:

1.Web3 is a digital space that transforms economic and social activities by storing identity, assets, and value in the digital world.

2.Investors in Web3 provide funding and have a holistic view of the market to make informed decisions, with a focus on infrastructure and applications.

3.Building investment logic in Web3 requires a knowledge of the industry, direction, and adaptability as the market evolves.

4.Infrastructure and application layers in Web3 have a symbiotic growth pattern, and investing in the application layer is more difficult but has explosive opportunities.

5.Moonshot Commons supports entrepreneurs with a big vision and invests in both infrastructure and upper-layer applications, particularly user onboarding, developer tools, privacy solutions, and cryptographic methods.

“Web3 is a natural extension of a long-term vision for the crypto world.”

Moonshot Commons:

The Web3 space is constantly changing as history evolves and the market iterates. What was your initial exposure to Web3 and what was your perception of it? Why did you choose to stay?

Yi:

In the early days of the cryptocurrency world, the focus was primarily on digital assets. However, as the use cases for Bitcoin and Ethereum expanded, the industry gradually evolved toward what is now known as the ownership economy. This transition was a natural progression that has led to many of the innovative concepts that are being discussed in the context of Web3 today.

I was first exposed to the crypto world while attending Columbia University in 2016. At that time, there were many Web3 companies in New York, and I often visited them. One of the more interesting ones was ConsenSys in Brooklyn.

Ethereum had just been launched in 2015, and ConsenSys, as one of the biggest players in the early days of Ethereum, was still relatively small, with around 50 people. I met the founder, Joseph “Joe” Lubin, in an old, run-down factory in Brooklyn, and learned that a team of developers was working on developing tools for the Ethereum ecosystem.

At the time, I had little knowledge of the area but found it interesting. The products I saw then were quite primitive, including Metamask, which had limited use cases. But one of the projects inside was uPort, a project for identity and access management, which caught my attention. Out of curiosity, I chose to join the team part-time and contribute to the product development of the project, which marked the beginning of my journey in the crypto world.

Moonshot Commons:

You originally came to Web3 as a developer with a CS background. What was your thought process in transitioning from a developer to an investor?

Yi:

Since I come from a technical background, I was initially less interested in cryptocurrency itself and more concerned about the changes in the authentication system from a technical perspective. For example, people used to use internet sites by registering using their emails and maybe adding a secondary authentication.

If we don’t consider the commercial single sign-on solution provided by Facebook or other websites, the identity systems between websites are not connected to each other. Yet, the crypto world embraced the new identity system since the beginning. It is equivalent to having one identity system across different applications, and you can use the same set of standards to log in to different applications. This was a very interesting point to me at that time. Because I did information security-related work before, a large part of my work focused on identity systems and identity access management. You will see a shift in the technical framework of the whole identity system.

Upon joining Qiming Ventures in 2019, I encountered a challenging phase in the industry, commonly referred to as the “winter.” During this period, the lack of good applications was a significant issue. There were many Layer-1s, but DeFi and NFT had not been well-established, leaving everyone with mere speculation about the application layer.

At that time, I had faith in the industry’s long-term growth, but to be honest, I felt somewhat lost and sought direction on how to play a more effective role in its development. As I transitioned from New York back to China, I aspired to foster a deeper connection with the entire Chinese entrepreneurial community. Despite my extended stay in the U.S., my Chinese roots instilled in me a strong sense of empathy for the Chinese and Asian entrepreneurial community, so I hope to support entrepreneurs of Chinese background as an investor.

“The development of the crypto field is actually part of the digital process of all human beings.”

Moonshot Commons:

You mentioned that your first exposure to the crypto space was in Brooklyn, New York. Do you think there is a Web3 culture in these cities? With the involvement of more traditional Internet companies today, what has stayed constant throughout this period of innovation?

Yi:

The U.S. is still leading a lot of the cutting edge in Web3 and encryption, especially at the protocol and infrastructure level. After all, it has accumulated a lot of basic research in the whole area, including cryptography. Specifically in terms of cities, New York and the Bay Area are the two places that I feel have the best talent density and atmosphere.

I believe NewYork is one of these cities, because it has some historical reasons includes the earliest use cases in crypto. Whether it is Bitcoin or Ether, all have very heavy financial attributes. New York, the so-called financial center of the old world, is rooted in the old financial system but at the same time, there will be a group of people who also want to break it and innovate. This is the reason why a group of people like Joe naturally emerge from New York.

Joe has experience working on Wall Street and in traditional finance. He mentioned in an interview that a lot of the innovation in crypto and Web3 came from a distrust of the old system or disruptive innovation.

In my opinion, New York as a crypto hub with its connections to finance, technology, and art has laid a good foundation for the community and is still in line with the spirit of Silicon Valley that everyone talks about.

Whether it is the crypto field or the mobile internet, the core of it is that innovators challenge the old system and then subvert a whole set of paradigms through technical means and products.

In fact, the first group of people who led the transformation was all very “rebellious”. Tech geeks could get a good salary working for a big company, but they were willing to take higher risks and build a new world outside the system. Regardless of the age, this kind of story is repeatedly played out. As an investor, this kind of spirit is a must, and you need to identify with the attitude of innovation from the bottom of your heart.

Moonshot Commons:

Can you expand on what you know about Web3 so far?

Yi:

My understanding of Web3 is rooted in the user’s perspective and my vision of what it may become in the future. To some extent, Web3 is building a so-called digital world. From a higher angle, human society has been advancing digitization for many years.

This shift began when the Internet era made it possible to access and distribute information digitally, leading to the world becoming faster, more flexible, and more convenient. In this new digital space, organizations can be more agile in recruiting people, and global collaborations are made possible. Your access to information today is a thousand times easier than it was 20 years ago. Previously it was simply information, but what is already happening in the future or now is the penetration of digital into the shape of organizations and the transfer and acquisition of value, which will potentially affect law and society. Transactions have also taken on new forms, enabling an artist from South America, for example, to have their work accessible and distributable to a collector in Europe. These developments in the crypto field are part of the digitization process of humanity as a whole. As a result, most of a future person’s economic and social activities will be conducted in the digital world: identity, assets, and value will all be stored here. There is more than one digital world and you can live in multiple digital worlds simultaneously. This is a game changer for our existing world.

Moonshot Commons:

It’s often said that everyone is a builder in Web3, so why did you choose to be involved in building Web3 as an investor? What is the role of investors in Web3?

Yi:

In general, investors are a vital part of the Web3 ecosystem and play a key role in driving the industry’s long-term trends. As an investor, it is important to be mindful of the potential impact that a team’s work can have and to provide the necessary funding to support its development.

There are various areas of focus that investors can choose from, with intersections between infrastructure and applications. Investors must have a holistic view of the market to make the best decisions for their investments. This is a unique role that investors have in the Web3 space.

Moonshot:

How did you establish your investment perception? How has it changed over the years?

Yi:

Cognition is a gradual iterative process. Much like product developers, entrepreneurs should have a general sense of direction at the beginning and understand what they want to do. Yet, in the process, they may find that the results are not exactly the same as expected, so they keep iterating and learning more than once.

Similarly, for investors, we have to build a perception of the whole industry, but the source still lies in the collision with the entrepreneurs.

On a daily basis, we engage in discussions with many project parties to closely monitor the various directions pursued by each project. Even a single direction often attracts multiple teams. Personally, I have found these interactions to be immensely informative, contributing to my own observations of the market. By engaging in exceptional communication practices, we are able to develop a comprehensive conclusion that effectively integrates the diverse views, ideas, and feedback of all parties involved. This collaborative approach is the most vital source of information for shaping our perspective on the industry.

In addition to our daily engagements with project parties, we conduct in-depth analyses to develop a narrative, or a visionary outlook, for the future of the industry. This involves contemplating potential use cases that may emerge as the industry matures, as well as envisioning the requisite level of infrastructure development that will be necessary to support these use cases. Our independent perspectives on these issues contribute to our overall understanding of the industry, which is informed by a synthesis of various perspectives and insights.

An additional critical factor is timing assessment. We carefully evaluate the present stage of industry development, identifying its current needs and gauging whether it is too early to make certain attempts. Our assessment of timing is grounded in a rigorous and objective perspective, enabling us to make informed judgments on this crucial aspect of investment.

Moonshot Commons:

What do you think are the areas that are overemphasized in the crypto world now? What areas are still relatively vacant and require more builders?

Yi:

One area that I think is excessively emphasized in the industry, albeit a contentious one, is Web3 social. While it holds immense potential and imaginative possibilities in the long run, its current use cases remain relatively limited based on my personal observations. From an ordinary user’s perspective, it is worth questioning what ultimate value Web3 Social brings to them, or whether it will trigger many activities. Despite Web3 receiving more emphasis than cryptocurrency, the industry’s main activity still revolves around finance and transactions at its core.

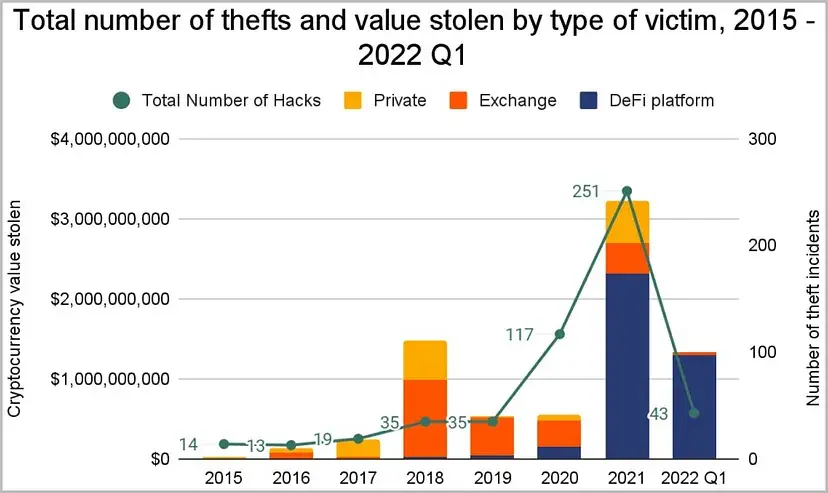

On the other hand, what is likely to be underestimated by everyone is actually the security issue. If you are going to build a digital world, security is still very important because no one would want to live in an insecure digital world. From a long-term perspective, assuming that all your assets and activities in real life remain here, you certainly don’t want this world to be gone tomorrow, right?

The security issue must be taken seriously throughout the industry at both the infrastructure and application levels. Many of the security incidents that we observe today are a result of passive testing of these systems. In this regard, the Ethernet ecology is making commendable progress. Ether, for instance, emphasizes the importance of decentralization and aims to utilize cryptographic methods for scaling and privacy to establish a more secure foundation. In this context, decentralization is not merely a slogan, but rather an essential means to ensure security.

“The infrastructure layer and the application layer are exhibiting a symbiotic growth pattern, where each layer enhances and reinforces the development of the other in a continuous upward spiral.”

Moonshot Commons:

The Web3 space is starting to see some breakout applications, but why did you choose to focus primarily on infrastructure? Was it a long-term consideration or was it just timing?

Yi:

Qiming will focus on both the underlying infrastructure and the upper-layer applications in this space — there are opportunities on both sides, and each has its own value to the industry.

In terms of how to define the relationship between infrastructure and application, I personally believe that there is an upward spiral between the two. At various stages of industry development, we may observe instances where the infrastructure is somewhat overdeveloped with limited application. At other times, the application catches up and generates greater demand for infrastructure, thus prompting it to catch up accordingly.

A specific example is around 2018 and 2019 when everyone was focusing on Layer-1. One of the major problems of the industry at that time was that if there was no application, what did we need so many chains for? But later, as DeFi and NFT developed and attracted more users, people realized that with the spillover demand from Ethereum, multiple chains were still quite useful.

At the current stage of the industry, it appears that the application level is once again lacking, with the exception of DeFi, which is a fully-fledged application, and NFTs, which are still emerging. Meanwhile, the infrastructure level seems to be over-developed. As a result, there is a growing focus on identifying the next application scenario, which is part of an ongoing upward spiral process. This is my observation. Given my background in computer science, I have a better understanding of infrastructure projects. The infrastructure companies we have invested in previously have proven to be particularly valuable to the overall ecosystem, as they have reduced the barrier to entry for developers and made many underlying processes more accessible.

Moonshot Commons:

What are the strategic and predictability differences between investing in infrastructure and investing in the application layer?

Yi:

From an investment perspective, the Infra layer is more predictable. Basically, an understanding of technology trends will bring a vision of the future. For example, it is very clear at what stage must the threshold be lowered or, from a technical perspective, which building blocks are likely needed. Infra is subdivided into many directions below.

I would classify this type of user onboarding as infrastructure as well. The process comprises two parts: one for individuals, such as ordinary To-C users, and the other for organizations, which is on the To-B.

If more users are onboarded, a lot of work needs to be done, including providing better self-custody wallets. Additionally, many projects are exploring cryptographic methods to create hardware wallets, which is a To-C level consideration.

It is more intricate regarding developer tools, such as indexing on various chains to simplify developer access to chain data. For instance, many projects still require the underlying nodes to run, operate and maintain by themselves, and these are issues that professional infrastructure companies can address.

On the contrary, the predictability of the application level is relatively weak. It has quite a few directions, and there will be some very popular models, including STEPN and NFT avatars, etc. But it is hard for anyone to give a definite answer when the unicorn applications will come out and in what shape.

I personally think the application layer is actually more difficult and unpredictable, but it doesn’t mean that investors shouldn’t invest in this direction, because unicorn opportunities exist. And the investment team has its own internal division of labor, which requires different investors to have a deeper knowledge of each direction to make more investments.

On the Application layer, I am more optimistic about the game category. Instead of GameFi, I hope that there will be more digital native things with the characteristics of the crypto world, such as value transfer or connecting the identity system and payment system.

Moonshot Commons:

Besides the user onboarding and developer tools mentioned above, what other specific directions are you focusing on?

Yi:

In the longer term, I am more interested in the application of cryptographic methods (such as zero-knowledge proofs) in this area. For example, are there libraries that provide easy ways to make the latest cryptographic methods available to everyone.

This aspect of the chain has a more immediate demand, and scaling is a topic that is frequently discussed and we are optimistic about. However, privacy is also an area with many challenges. From a user’s perspective, living in a digital world where every action is exposed to the public view is unreasonable. It can allow anyone to invade their privacy, and monitor their whereabouts. Therefore, we believe there is a need for better privacy solutions that enable users to selectively display content.

“Web3 empowers participants to contribute to the construction of every node within the entire system, thereby enabling a decentralized approach to system development and maintenance.”

Moonshot Commons:

Can you talk a little bit about the details of your investment work? For example, what teams or projects stand out to you?

Yi:

First of all, a key conclusion is that we want to support entrepreneurs who have a big vision and belief, who are very committed to their direction and are constantly building. A specific example is our previous investment in InfStones, a Web3 infrastructure provider.

When we first met with the CEO in late 2019, we talked about node services. It may not sound like much at first, but he made the point that Web3 has highly compartmentalized software systems. For example, if you look at the traditional Amazon AWS cloud, it is both the designer and operator of the entire system. Web3 is very different in that it allows for a further division of responsibilities among the participants.

In addition to the developer and protocol designer, there is also an important role for the operator in the crypto industry. While they may not build the software themselves, operators play a critical role in maintaining the stability and reliability of the network. These three roles are distinct but interconnected.

In the crypto world, every component requires a dedicated professional company or participant to develop and maintain. InfStones is an excellent example of a company that specializes in the large-scale operation of node software, which is an impressive feat. While some may view running nodes as merely a means of generating revenue, I believe that truly visionary entrepreneurs have a long-term perspective and are dedicated to realizing their goals one step at a time.

Moonshot:

In your opinion, what are the qualities of successful teams that you have invested in?

Yi:

One of the most crucial aspects of building a successful startup team, especially in the early stages, is team building. The rapidly changing nature of the industry and the presence of numerous unknowns and unpredictabilities make this even more essential. Therefore, in the early stages, the focus should be on building a strong team foundation. As an entrepreneur, it is advisable to seek out a suitable co-founder who can complement your skills and personality traits.

Choosing the right direction for your startup is crucial to its success. While popular trends may seem appealing in the short term, it’s important to consider the long-term value of your chosen direction. Even if it’s not currently popular, with a strong team and a solid work ethic, you can achieve success. For example, NFTs may currently face skepticism due to past bubbles and low-quality projects, but a committed team can achieve their long-term goals at any stage.

Moonshot Commons:

How does the Web3 team differ from traditional companies in terms of philosophy or how they are built?

Yi:

Firstly, similar to traditional companies, building trust among the early core team, possessing complementary skills, maintaining effective communication, and sharing common beliefs are essential for successful startup teams in the Web3 industry. However, Web3 also introduces new features.

One such feature is that the Web3 world is global in nature. Geographically speaking, early teams may be relatively more decentralized, with core employees located in different countries or regions, yet still being able to collaborate remotely effectively.

Secondly, the industry can be more cohesive in its early stages. Community engagement is a key channel for finding individuals to contribute to projects. Enthusiastic community members may work part-time or even volunteer to help a startup achieve many things.

Thirdly, the industry tends to be more youthful in terms of entrepreneurship. Younger individuals may have fewer ideological constraints and may even be able to create more disruptive projects. Additionally, young people possess the energy to keep learning and adapting to an ever-evolving industry.

Moonshot Commons:

You mentioned that young people have a natural advantage in the Web3 space, what are your impressions of the young entrepreneurs you’ve come across? What criteria do you use when investing in people?

Yi:

Young people bring a unique advantage to the crypto industry with their ability to break down boundaries in their thinking and their comfort with concepts like the metaverse. While experienced builders consult with young dropouts to stay on top of industry trends, investors still objectively judge a team’s suitability for a project based on the foundational skills required. Infrastructure projects may require traditional internet and cloud maintenance skills, while young people excel in To-C projects with their ability to adapt and embrace new environments. Recent graduates with specific research expertise can also prove irreplaceable. Ultimately, investors evaluate a team’s long-term conviction and alignment with the project’s direction.