At Moonshot Commons’ Web3 Fireside Chat #8, we invited several of our friends and community mentors to participate in an AMA (Ask Me Anything) session on Twitter Space.

Our guests include Joshua, founder of RSS3; Jack, founder of Aspecta; Dr. Zhang, co-founder of Zettablock; Kacie, founder of LearnWeb3; Ishanee, principal of IOSG Ventures; Andy, founder of Blockchain Academy; and Gua, co-founder of Moonshot Commons. During the session, they shared insights and experiences on building startups in the Crypto Winter. This is a Moonshot AMA hosted at Twitter Space. Follow the official Moonshot Twitter feed @buildmoonshot to get the recording and interact with us! Key Takeaways:

1.Crypto Winter is a rare opportunity for the ecosystem and the best time for developers to survive and grow.

2.Angel investors often open more doors for you and bring more practical benefits than you can imagine.

3.Don’t halt company operations and waste time waiting for funding.

4.Build trust between the product and users and focus on creating brand loyalty.

5.Consider a ‘Land-and-Expand’ strategy to get users started in any way.

6.Recruit people who would be willing to ride out a bear market with the team.

“The bear market is a rare opportunity for the ecosystem and is the best time for developers to survive and grow.”

Moonshot Commons:

Could you please introduce yourselves first?

Dr. Zhang:

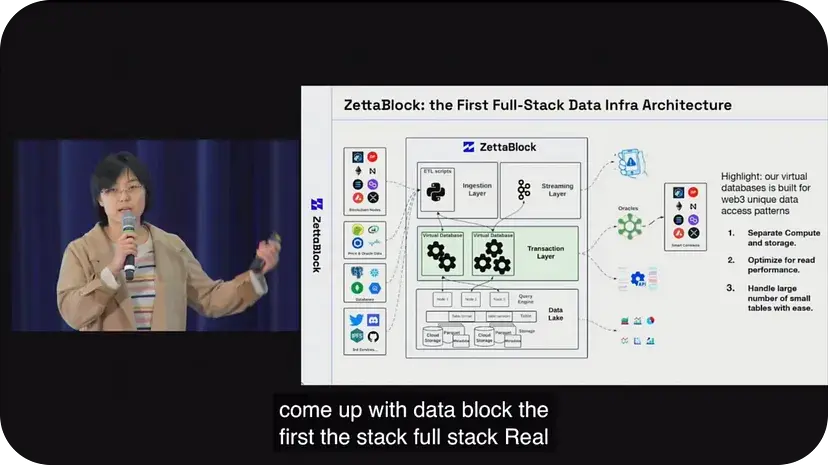

Hi everyone, I’m Chi, co-founder of ZettaBlockHQ. I previously worked at Databricks, a Web2 Data Infra company. Before that, I got my Ph.D. from UCB in Statistics and went to an early-stage startup making an automated machine learning platform. ZettaBlockHQ is the first full-stack and real-time data infrastructure for indexing and analytics. Developers can build reliable APIs in minutes via SQL, and it is now used by several applications and protocols, including OpenSea and Polygon. Jack:

I’m Jack, co-founder of Aspecta. We’re building the next generation of digital identity across Web2 and Web3. Aspecta uses artificial intelligence to analyze data from tens of billions of code projects, social tweets, patents, papers, and on-chain transactions. This identity serves as proof of a developer’s ability to contextualize their programming skills and contributions.

We were very fortunate to participate in this year’s Hackathon at Moonshot to allow more developers to learn how Aspecta’s digital identities can empower the workplace, social contact, and beyond. I just graduated from Yale in May, but have been specializing in this field for two years.

AI-powered digital identity ecosystem. Source: @aspecta_id. Ishanee:

I’m Ishanee from IOSG. We have invested in companies like Illuvium, Big Time, and Alethea AI. Founded in 2017, IOSG is a research-driven, early-stage crypto fund focused on two major tracks: infrastructure and application. Andy:

Hi everyone, I’m Andy, the founder of Blockchain Academy (BA). BA is a non-profit organization bringing more people into Web3 by promoting related knowledge. We welcome anyone who wants to get into the Web3 world to be a part of BA’s audience.

Joshua:

Hi everyone, I’m Joshua from RSS3. As the name implies, RSS3 is the next generation of decentralized social and content protocols for Web3. RSS3 is supported by organizations including Coinbase, Dragonfly, and Fabric, enabling over 20 applications with over 25 million requests submitted each month. If you’re building a social app, RSS3 is a good choice. Moonshot Commons:

What was the moment when you could feel the onset of a market downturn toward Crypto Winter? How should people better prepare for the bear market?

Haardik:

I don’t think winter is coming, because it’s already here.

The price regulation and the shift in investor decisions over time have made it visible to everyone. A few months ago, a number of my friends saw their new valuations plummet, and this was one of the signs that the market was in for a cold winter. It all seemed to cut off the top of the funnel — and when it did, it set off a chain reaction.

Dr. Zhang:

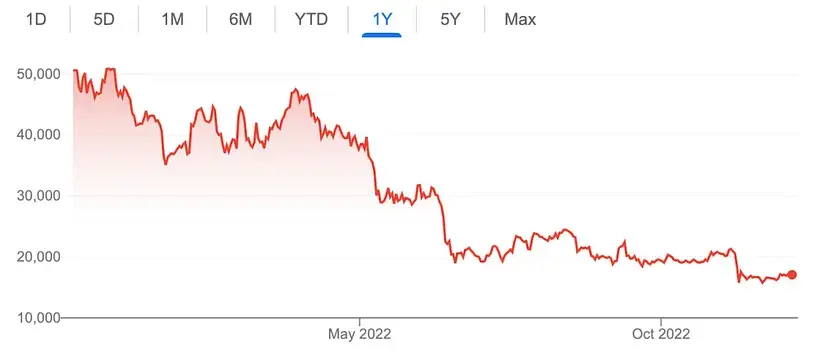

On the data side, two main metrics have dropped significantly.

ZettaBlockHQ started building Infra because other Infra tools couldn’t handle the data the Solana ecosystem was generating. Since last November, the KPIs have dropped by almost half. We also worked with a number of enterprise users at the same time, and the shift in data such as NFT transactions was obvious. When we really see the winter coming, the most stable source of revenue is still these enterprises. They still have budgets in IT, especially Infra, but the overall budget is inevitably much lower.

Ishanee:

The Crypto market is cyclical by nature. Once the cash outflows outweigh the inflows, the process begins. We really noticed this phenomenon between December of last year and the beginning of this year. From Terra Luna to FTX, many things follow patterns. Product development takes time in a bear market, but IOSG is supporting a few teams as we’ve noticed that developers tend to be single-mindedly devoted to their products during this period. With fewer distractions from market declines, products are in turn more likely to be sustainable. To some extent, investors may feel that a bear market is a good time to evaluate a project, but for IOSG, the overall strategy will still follow the direction determined during a bull market to move forward.

2022 Bitcoin Pricing Trend. Source: Google Finance. Jack:

Aspecta often participates in major Hackthons and stays in frequent communication with the developer community. We’ve found that even in winter with declining valuations, developers haven’t lost faith in the projects at hand. As Andy said, Aspecta’s goal is also to get more Web2 developers into Web3.

Starting next year, Aspecta will have two events. One is a trip to some of the traditional Web2 technology companies to explore the connection between Web2 and Web3. The second is to travel with other teams to university campuses to showcase the developments happening in Web3 right now and provide more people with an opportunity to learn about it.

I think the enthusiasm of the developers isn’t related to the ‘possibility’ of the future because what they are envisioning and building is our future. Web3 and crypto are still in their early stages, and most of the people who chose to enter are not in it for the money, but to create. No matter how valuations change, people will not give up on moving forward, but for startups in the growth stage, cutting back on funding is not a small challenge.

Joshua:

Yes, even in a bear market, good developers don’t choose to leave. I think this is a unique opportunity for the ecosystem to clear up the clutter that has been created since the year of DeFi Summer. The situation now is that there are more speculators than real developers in the market. In a bear market, without the incentive of visible financial returns in the short term, the remaining developers will instead focus on projects that have a meaning, not just for the cash.

This is also a good time to recruit and invest because people have relatively lower expectations. However, our team will not change much and will still operate at the right pace and under specific rules.

Jack:

I very much agree that the bear market is the most suitable time for developers to survive and grow. Even VCs are divided into speculators and real supporters, and the winter is a good time to differentiate them.

“Good angel financing will open many doors for you; a good team will accompany you through the bear market and into the next cycle.”

Moonshot Commons:

Everyone is facing many challenges in the Crypto Winter, both in terms of funding and people. What advice would you give on financing? Should we respond now or keep waiting?

Ishanee:

The current situation is tough, but you will find that there are still VCs who are willing to support developers. As long as your project can provide long-term value, you should seek funding. However, people shouldn’t raise money for the sake of raising money. They should just get the amount they need to grow their product. There are still many projects in the past that will issue tokens as a way to increase revenue, but that’s not going to work in the present day.

In the crypto world and the broader economic market, I would suggest 6–9 quarters for a runway.

Kacie:

I would like to share three pieces of advice with entrepreneurs when it comes to raising capital in bear markets:

First, don’t halt your company’s operations. There was a time in the bear market when Haardik and I spent a lot of time raising money and neglecting the day-to-day progress. If you already have users, scale, and a small team, remember not to put all your eggs in one basket for financing. While realizing the big blueprint, you can’t let go of your focus on the community.

Second, many things can be done without spending too much money. We didn’t have much money for marketing and user growth, but the people in charge were able to grow nearly 50,000 users by using various free tools in conjunction with operational strategies. If we had just sat around waiting for funding and doing nothing, we might not have been able to achieve this goal.

Third, before talking to VCs, your product should already have some tangible success.

Dr. Zhang:

Kacie just shared some great insights. From my experience, if a project wants to show its value in the Crypto Winter, it must have solid technology, clear goals, and a tangible product, not just a community to prove what you can offer. Of course, I’m not absolutely certain about this point, because ZettaBlock is about building the product first, completing the testing, and then growing the community. That way we have the confidence to present the technology to everyone.

Since ZettaBlock is providing a full-stack digital infrastructure setup, we chose to start with enterprise users in the first place. We can see clearer cases of usage internally, and enterprises are willing to pay for the product. Once an enterprise chooses to adopt our product, it’s a good sign that there is demand. ZettaBlock is not just for enterprises. At the end of the day, we are providing such a tool for the entire developer community, both individuals and enterprises.

Fortunately, after the bear market hit, several investors expressed interest in supporting us for the long term because they saw that ZettaBlcok was making a real product that was already being adopted on some scale. As Kacie suggested, it’s important to build your product and not just waste time.

One mistake we made in the seed round was not bringing in enough influencers. We got a lot of funding from VCs, but we were rarely noticed by potential product users, including entrepreneurs and KOLs. This is something we will improve in our next round of funding. Good angel investors often open more doors for you and bring more practical benefits than you can imagine.

@ChiZhangHi Introducing Digital Infrastructure. Source: ZattaBlockHQ. Moonshot Commons:

In the face of the Crypto Winter, when people are disillusioned and lose confidence in the future, how will you maintain the team’s stable growth?

Joshua:

The question of how to keep the team faithful is not only limited to bear markets. There are indeed teams that have managed to stay true to their product through the downturn and stick together through the next phase of rapid growth. Therefore, I think one thing I’ve learned from this is not to recruit people who would not want to ride out a bear market with the team.

If you spend a lot of time recruiting, it’s not hard to tell what employees are looking for when they apply, whether it’s for financial rewards or product innovation. While you can’t ensure that everyone is fully invested in the product, at the very least, you need to have a clear understanding of the attitude toward the bear market. Especially for startups, the tougher the market, the more you should give preference to core members to minimize unnecessary losses.

Andy:

In 2021, I was talking to some people who predicted that 99% of VCs would shut down this year. That seems to be the trend right now. We understand that Web3 is not just about crypto and token, it’s about the core technology. Therefore, it’s not the money that affects the team; it’s how they position themselves. A Hong Kong company I worked with once said they wanted to get into Web3. I asked them what they wanted to do with so much IP in their hands, and they replied that they simply wanted to digitize what they had. Maybe there’s more than one company that doesn’t know what they’re doing and just wants a piece of the Web3 pie. That’s not going to work.

Jack:

The team at Aspecta has always understood that the market has its ups and downs. When we initially hired, one of our primary criteria was that members should have a shared belief in each other, so that they could develop close relationships over time and trust each other. In a start-up, monetary rewards should be far from the primary goal. Whether it’s “summer” or “winter”, I hope that the morale of the team never falls.

We put a lot of effort into iterating the product, and we’re fascinated by Aspecta’s effectiveness in everything from data to partners. For example, we gained 130,000 users in just 624 hours. That’s a great motivator for our team to keep moving forward.

In a bear market, if we keep the momentum going, I’m sure we’ll be able to tackle all the problems.

Moonshot Commons:

Can you share some of your experiences with marketing?

Kacie:

One thing I learned early on is that brand loyalty is essential if you don’t have the money for marketing and you want to build a high-level program that has an impact. When we were doing testing, the methods that we use are actually very basic, like a Google questionnaire or something like that. I later found out that it’s not just the product that attracts a lot of users but rather the atmosphere that your community creates. If there were a thousand burger restaurants in the world, what would attract you to go to one of them? What would attract users to learn about Web3 and become part of the community?

As a founder, my focus is on how to build trust between the product and the users. In the community, we connect with people one-on-one and allow them to have a deeper connection with the brand. We spent $0 to gain almost 100,000 users today. If we can do it, so can everyone else.

Dr. Zhang:

When ZettaBlock started, we were more ToB-oriented (To Business), so I’d also like to share some advice on working with enterprise users.

We didn’t have too much budget at the beginning, so I think it’s important not to have concerns about getting contracts, but to get users started in any way you can. SaaS has a similar strategy called Land-and-Expand, which means selling products to customers on smaller contracts and then expanding over time. As Kacie mentioned earlier, it’s important to build trust first, and brand loyalty is important not only for ToC (To Customer)but also for ToB. Scale is secondary in importance in the beginning. You can only get customers to would spend money on the product and develop a long-term relationship by gaining their trust. For example, if you start with the finance department, once there is some success, they will automatically recommend the product to other departments. That’s when you realize the potential and value of a business.