Back

Rug Pull

Slang

By HackQuest

Apr 2,20245 min readWelcome to the world of Web3, where cryptocurrencies, blockchain, and a unique culture converge. Entering the world of Web3 can be both thrilling and overwhelming, especially when faced with the seemingly cryptic language used by enthusiasts. Don't worry if you feel they sound like some secret codes, we are here to unravel their meaning. In this article, we are going to introduce [Rug Pull].

What is the meaning of Rug Pull?

A "Rug Pull" is a term commonly used in the cryptocurrency world to describe a type of scam where developers of a new cryptocurrency, token, or project suddenly withdraw all their funds from the liquidity pool or project wallet, abandoning the project and leaving investors with a worthless asset. This term comes from the expression "pulling the rug out," implying that the support or foundation is suddenly removed, leaving those involved with no support.

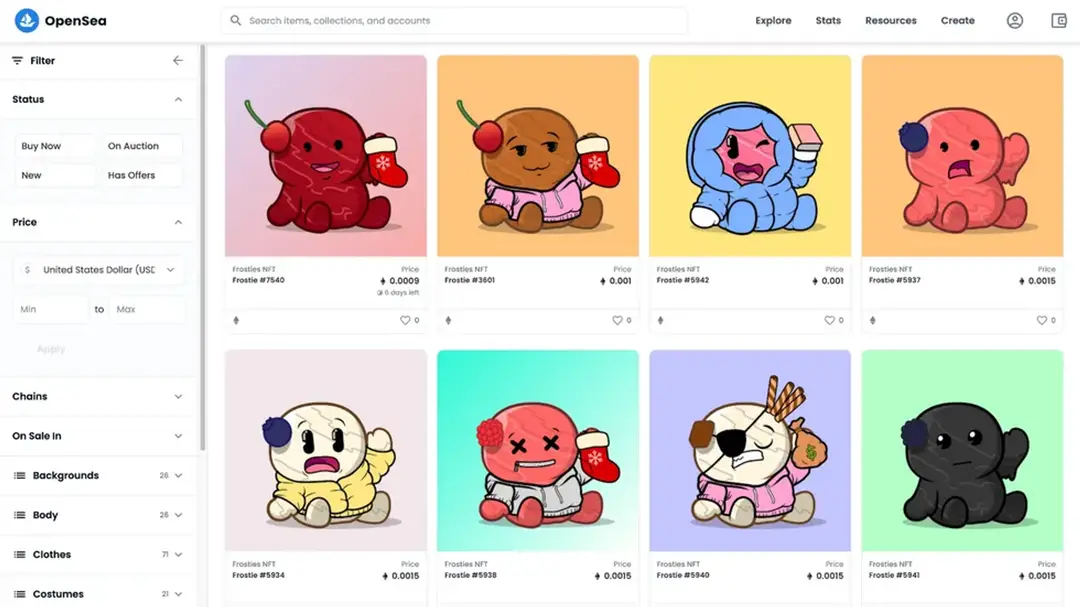

The U.S. Department of Justice's first NFT "Rug Pull" bust - Frosties NFT project

The Frosties NFT project, created by Ethan Nguyen and Andre Llacuna, promised investors unique digital art and future rewards but became infamous for a "rug pull" scam. After raising approximately $1.1 million, the founders abruptly abandoned the project, transferring funds to various wallets in an attempt to launder the money. This left investors with valueless NFTs, devoid of the promised benefits. In March 2022, the U.S. Department of Justice charged Nguyen and Llacuna with fraud and money laundering in what is considered to be the agency’s first NFT “Rug Pull” bust.

Source: Protocol

Types of Rug Pulls

Liquidity Stealing

This occurs in decentralized finance (DeFi) projects. Developers set up a token and pair it with a leading cryptocurrency like Ethereum in a liquidity pool. After accumulating a substantial amount of the paired currency from investors, the developers withdraw the entire pool, stealing the investors' funds.

Dumping

In this scenario, the project creators initially hold a significant amount of the project's tokens. After hyping the project to increase its value and encourage investment, the creators sell (or "dump") all their tokens at a high price. This massive sell-off floods the market, causing the token's value to plummet, often to the point of being worthless.

📢

How to Avoid a Rug Pull

Due Diligence and Research

Thoroughly research the project, its team, and its history. Look into the project's whitepaper, development roadmap, and the credibility of the team members. Check for community feedback and independent reviews.

Smart Contract and Security Analysis

Pay attention to the security aspects of the project. This includes checking if the project's smart contracts have been audited by reputable firms and whether these audits are publicly available. Understanding the smart contract's functionalities can help identify potential vulnerabilities.

Monitoring Token Economics

Analyze the token distribution and economics. Be wary of projects where a large portion of tokens is held by a small number of addresses, especially if these are controlled by the project’s developers. Projects with transparent and fair tokenomics are generally safer.

Community and Transparency

Engage with the project's community and observe the level of transparency maintained by the project's team. A strong, active, and informed community can often provide early warnings about potential issues. Regular, clear, and honest communication from the project team is a positive sign.

Conclusion

Rug Pulls in the Web3 space serves as a stark reminder of the perils lurking in the decentralized finance and NFT sectors. These deceitful schemes, where developers abruptly abscond with investors' funds, not only lead to substantial financial losses but also undermine the trust in the burgeoning Web3 landscape. As enthusiasts and investors, we must tread with caution, do our own research (DYOR), and foster a culture of transparency and due diligence. In doing so, we can navigate these digital waters more safely and help shape a more secure and trustworthy Web3 environment for everyone involved.

🚀

Check out: What is the meaning of DYOR

If you would like to learn more about such Web3 slang, come and join us to explore more in our HackQuest Web3 Glossary!