Back

Front Running

Telos

Basics

By HackQuest

Sep 10,20243 min readWelcome to the Web3 world, where digital finance and applications are shown in a revolutionary way through the fusion of blockchain technology, cryptocurrencies, and a pioneering spirit. Are you overwhelmed by the wealth of terms in the Web3 world that you don’t understand? Are those slangs barriers for you to learn about Web3? Don’t worry! We’re here to explain the obscure terms to guide your learning. Today, we're diving into an essential concept in the world of Web3: [Front Running].

Overview

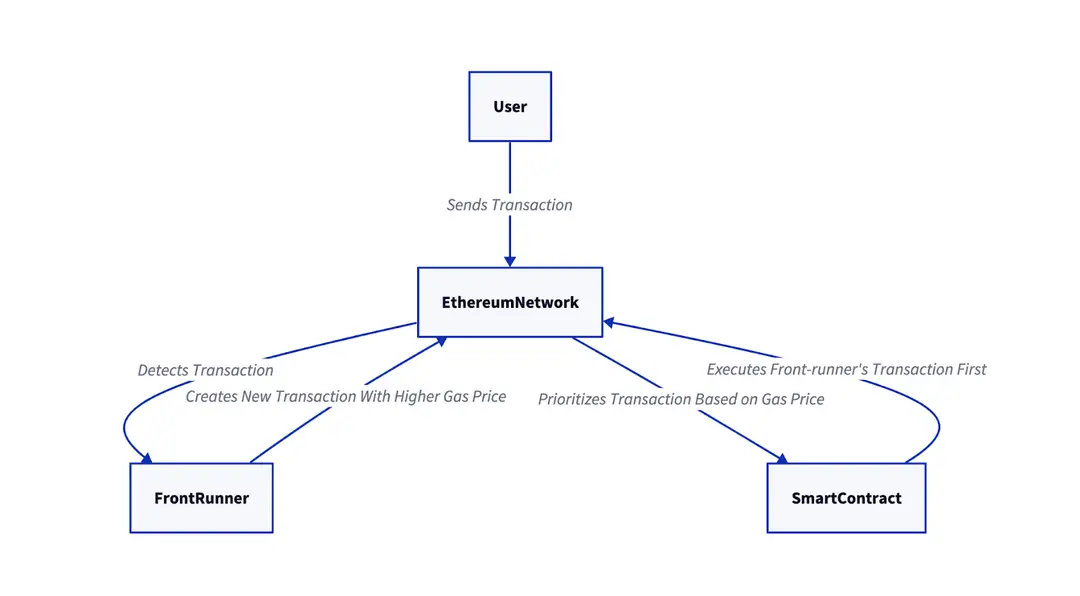

Front running refers to the unethical practice of exploiting prior knowledge of a pending transaction to profit. In blockchain, it typically occurs when someone, such as a miner or validator, gains access to transaction details before it is confirmed and then places their own transaction ahead of it, often at a higher gas fee. This allows the front-runner to profit by manipulating the order of transactions within a block, creating an unfair advantage.

Front running is common in high-traffic blockchain networks like Ethereum, where users compete to have their transactions processed first, especially during periods of network congestion.

Source: Hacken.io

How Front Running Works

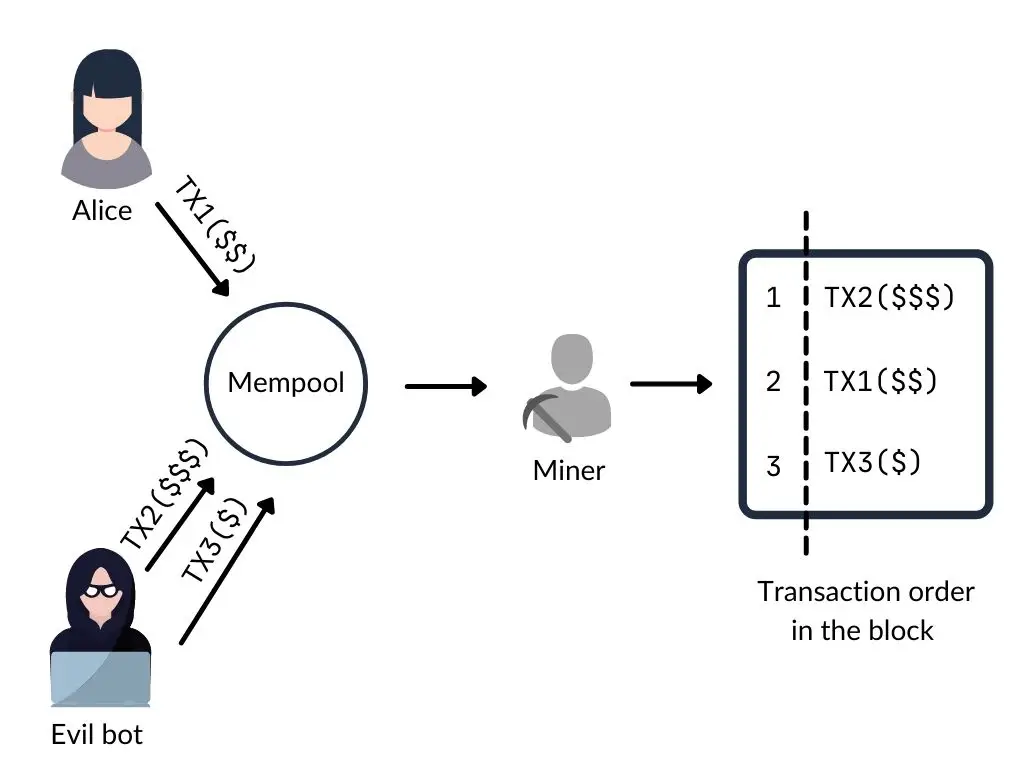

In blockchain, transactions are processed in a queue by validators or miners. Each transaction includes a gas fee, which incentivizes miners to include it in the next block. Front runners exploit this process by submitting their transactions with higher gas fees, ensuring their transactions are prioritized ahead of others in the same block. This leads to the affected user’s transaction being delayed or executed under less favorable terms.

Types of Front Running

1.Transaction Front Running: Occurs when a front-runner places a buy or sell order before the original transaction, taking advantage of price changes in assets.

2.Gas Fee Manipulation: The front-runner increases the gas fee of their own transaction to prioritize it over the original transaction.

3.Sandwich Attacks: The front-runner places both a buy and sell order around the original transaction, manipulating prices and profiting from the price movement caused by the original transaction.

Impact of Front Running

Front running leads to a range of negative consequences, including increased transaction costs and unfavorable market conditions. It compromises the integrity of decentralized markets and discourages users from participating, especially in high-frequency trading environments. For users in DeFi platforms or decentralized exchanges (DEXs), front running can cause them to miss out on trades or pay higher prices for assets than they would otherwise.

Mitigation Strategies

To combat front running, several blockchain platforms have implemented strategies, such as:

●Encrypted Transactions: Hiding transaction details until they are confirmed to prevent front runners from gaining access to pending transactions.

●Fair Sequencing: Platforms are exploring ways to sequence transactions more fairly, reducing the opportunity for manipulation.

●Private Pools: Using private pools to prevent public access to transaction details until after execution.

Source: Securing

Conclusion

Front running remains a significant issue in decentralized finance and cryptocurrency trading, but ongoing efforts to mitigate its effects are paving the way for a fairer and more transparent blockchain ecosystem. By understanding how front running works and the solutions being developed to counter it, users and developers can contribute to the creation of a more equitable decentralized financial landscape.